What Credit Scores Do Mortgage Lenders Use?

Published: August 8, 2025 | 7 min read

When applying for any mortgage, your credit score is a major determinant of your eligibility and interest rate. But did you know lenders don’t all use the same score? In fact, mortgage lenders often rely on specific versions of your credit score to make their decisions.

These scores come from the three major credit bureaus—Equifax, Experian, and TransUnion—and are based on scoring models specifically tailored for mortgage lending.

While you might regularly check your credit score through free services offered by credit card companies, banks, or online platforms, it's important to know that those scores often differ from the ones mortgage lenders actually use. That’s why understanding which credit scores lenders rely on can help you better prepare for the mortgage approval process.

Why Are Credit Scores Different?

The credit scores you access for free online often differ from the ones mortgage lenders use—and unfortunately, many people aren’t aware of this distinction or why it exists.

Prospective homebuyers often apply for a mortgage, feeling confident in their credit scores, only to be surprised when lenders see a lower score than expected.

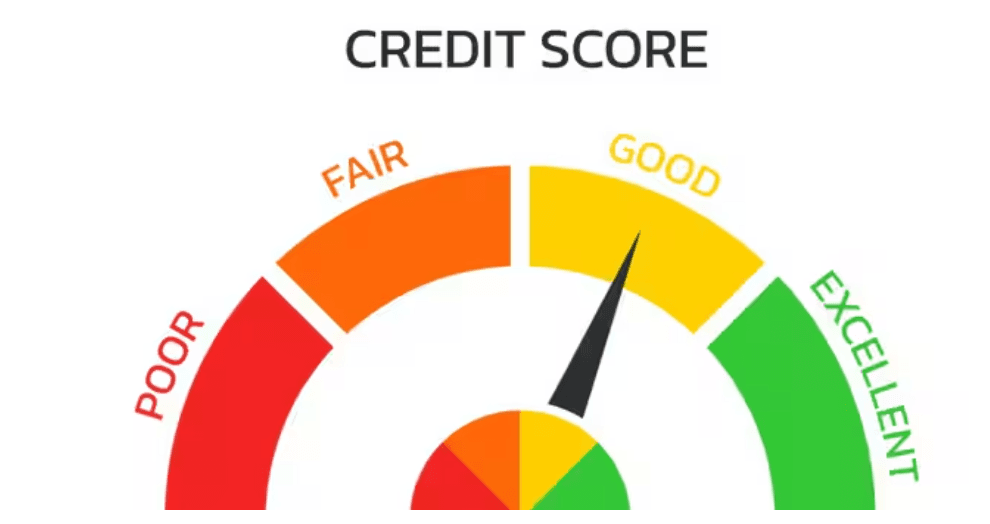

Credit scores are a key factor used by lenders to check a borrower’s ability to repay a loan. They also help predict the likelihood of a borrower falling 90 days behind on payments within the next 24 months.

Most often, mortgage lenders use FICO scores, not the free scores you see online.

FICO Scores: How Are They Different from Other Credit Scores?

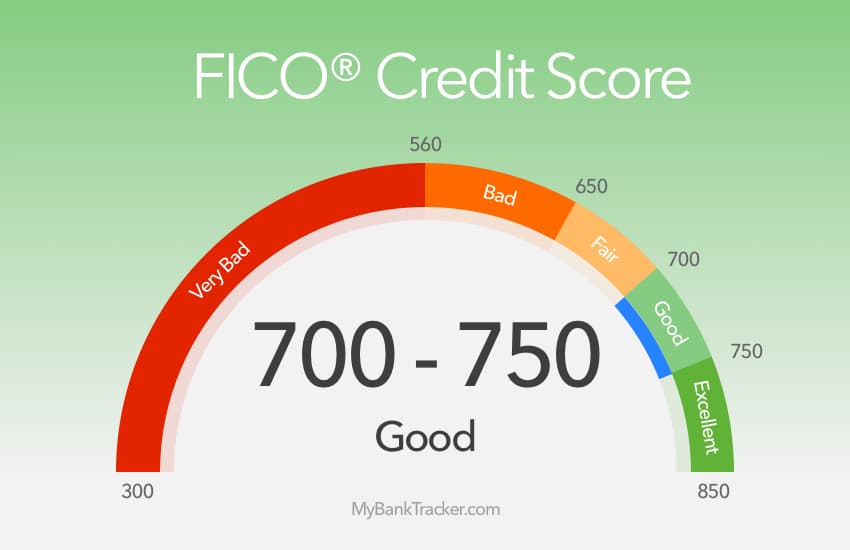

FICO, short for Fair Isaac Corporation, has long been a leader in developing credit risk models. Today, nearly 90% of mortgage lenders use FICO scores to evaluate a borrower’s ability to repay a loan within the agreed timeframe. In fact, FICO was the first to introduce a standardized credit scoring model back in 1989—aimed at creating a fair and consistent way for lenders to assess creditworthiness.

FICO scores play a crucial role in helping lenders determine loan terms and interest rates. There are multiple versions of the FICO credit score because each credit bureau regularly updates its scoring model to stay predictive and relevant.

Your FICO score is a three-digit number depending on your credit report, reflecting both positive and negative information. It indicates how much credit you currently have, how much you're using, and—most importantly—your repayment history, including whether you pay on time.

Remember: The main goal of credit scoring is to estimate the chances that a person will fall at least 90 days behind on a payment within the next 24 months.

Which Credit Score Does the Lender Use?

When a lender checks your credit, they’ll pull three scores—one from each of the major credit bureaus: Equifax, Experian, and TransUnion. So, which one do they actually use?

They go with the middle score. Whichever number falls between the highest and lowest is the one that gets considered. For example, if your scores are 695, 700, and 710, the lender will use the 700 score.

If there’s more than one applicant, the lender compares both applicants’ middle scores and uses the lower of the two to determine eligibility.

Here’s a simple example to understand this:

| Credit Bureau | First Borrower | Second Borrower |

| TransUnion | 680 | 720 |

| Equifax | 700 | 725 |

| Experian | 690 | 708 |

| Middle Score | 690 - This is a qualifying score | 720 |

What Criteria Are Used to Determine FICO Scores?

-

Payment History

Your FICO score is heavily influenced by your payment history—this accounts for nearly 35% of the total score. If your payments have been late or there have been other issues, your FICO score will likely be low. On the other hand, if your payments have been consistently on time, your score will be higher.

Ways to make your payment history credible:

-

Ensure that your past-due balances are as low as possible, as these reflect negatively on your credit score.

-

Make sure all your accounts are current.

-

Pay your bills before or on the due date every month. Stick to a budget to help manage this, and make sure you set up automatic payments to stay consistent.

-

If you're facing challenges in making your payments, communicate with your creditors as they may offer helpful tips or solutions.

-

Credit Utilization

This refers to the amount of available credit you're using, and it makes up about 30% of your FICO score. If you're using most or all of your available credit, your score is likely to be lower. The relationship between credit utilization and your FICO score is inverse—so the higher your utilization, the lower your score.

Ways to optimize your credit utilization ratio:

-

Instead of closing credit cards you no longer use, leave them open with a zero balance. This keeps your available credit high and your utilization rate low.

-

Calculate your credit utilization ratio & aim to keep it under 30%. Staying below this threshold has a positive impact on your credit score.

-

Credit History Length

About 15% of your FICO score is influenced by the length of your credit history. Usually, the longer your credit history, the better your score.

Ways to increase the length of your credit history:

One of the most effective ways to build a strong credit history is to keep your oldest credit accounts open—even if they have a zero balance. As long as these accounts remain open, they’ll contribute positively to the overall length of your credit history.

-

Credit Type Mix

This makes up about 10% of your FICO score. If your credit mix consists only of multiple credit cards and unsecured loans, your score may be lower compared to someone with a more balanced mix—such as credit cards, a mortgage, and installment loans. A well-rounded and credible credit mix tends to reflect positively. However, someone with only credit card accounts can still maintain a strong score if the accounts are managed responsibly.

Ways to optimize your credit mix:

-

Avoid taking on new credit types solely to improve your credit mix.

-

Limit the number of hard inquiries, as they appear on your credit report & can temporarily lower your score.

-

Regardless of the credit mix you have, always make timely payments on all your accounts.

-

Credit Applications

New credit applications account for 10% of FICO score report. Your credit report shows a two-year history of applications, but FICO scores specifically consider those made within the past 12 months. Keep in mind that every new application or account opened can potentially lower your score.

Ways to optimize your new credit applications:

-

Avoid applying for new credit unless it’s truly necessary. Be especially cautious during holidays when tempting offers from retailers are common.

-

Don’t apply for multiple new accounts in a short period of time. Doing so reduces the average age of your credit accounts, which can negatively affect your FICO score.

FICO Scoring Models

There are various models and versions used to calculate FICO scores, and the one applied often depends on your lender. This is why the free credit scores you see online may differ from the scores lenders use when making credit decisions.

Here’s a breakdown of the FICO scores typically used by different lenders:

-

Auto Loans: FICO Auto Scores 2, 4, 5, 8, and 9

-

Mortgage Lenders: FICO Scores 2, 4, and 5

-

Credit Card Companies: FICO Score 3, and Bankcard Scores 2, 4, 5, 8, and 9

Important Note:

The free credit scores you receive from platforms like Credit Karma typically use the VantageScore 3.0 model. These scores differ from the FICO scoring models that most lenders rely on.

Finding Your Actual Credit Score

It can be challenging to determine your true credit score due to the variety of scoring models. Rather than focusing on one specific number, the best approach is to consistently follow the practices mentioned in this guide to maintain and improve your score over time.

Keep in mind: everyone’s credit score is unique. Scores vary based on individual credit histories and financial behavior. Focus on building healthy credit habits, and you’ll be well on your way to a stronger score.

For personalized guidance, feel free to reach out to us at Total Mortgage.

Get Pre-Qualified in 60 Seconds!

Find out what you can afford with no hard credit check, just a few simple questions.

Select the type of loan that best fits you