All You Need to Know About the Credit Score Needed to Buy a House

Published: August 12, 2025 | 7 min read

When applying for a mortgage, your credit score is one of the first things lenders look at. Your credit score helps determine your mortgage eligibility and the interest rates you are eligible for. It also reflects your financial reliability and helps them analyze how likely you are to repay the loan on time.

A strong score can result in better interest rates and loan options, while a lower score may limit your choices or lead to higher costs. Understanding the minimum credit score needed to buy a home can help you prepare financially and increase your chances of loan approval.

Let’s explore credit scores in more detail.

Why Does Your Credit Score Matter?

When you decide to get a home loan, you’re committing to repaying a large amount of money over several years. With so much at stake, lenders are understandably cautious; they won’t lend to just anyone. Instead, they carefully evaluate a borrower’s financial health.

One of the first things a lender will assess is your credit score. This score gives them insight into your creditworthiness and ability to repay the loan on time. That’s why your credit score plays such a critical role in the mortgage approval process.

So, what credit score do you need to buy a house, and how can you improve yours to increase your chances of qualifying for a mortgage?

What Is the Credit Score Required to Buy a House?

In the U.S., a minimum credit score of 620 is usually needed to qualify for a home loan. However, this can vary based on the mortgage program and lender-specific conditions. Some lenders may ask for a score of 640, 660, or even 720 based on their terms.

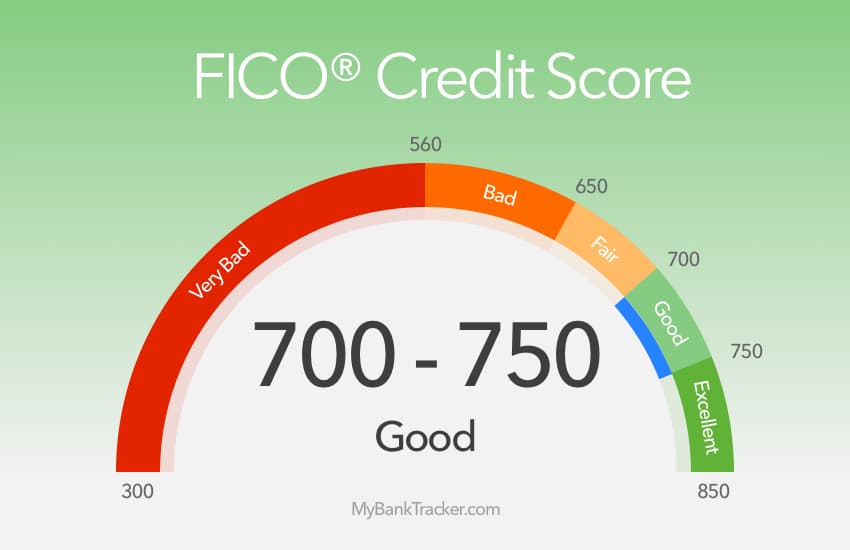

It’s worth noting that your FICO credit score reflects how you’ve managed loans and credit in the past. FICO scores typically range from 300-850, and your score can be checked in various ways—such as through your credit card statement, your card issuer’s website, or a mobile app.

The higher your credit score, the more trustworthy you look to potential lenders. This not only improves your probability of loan approval but also assists you qualify for lower interest rates.

That said, a lower credit score doesn’t automatically disqualify you. Some lenders may still work with you—especially if you have strong compensating factors like a sizable down payment or a solid employment and income history.

On the flip side, a high credit score alone may not guarantee approval if other parts of your financial profile, such as income stability or job history, don’t meet the lender’s standards.

Minimum FICO Score Needed to Buy a House

| Mortgage Type | Minimum FICO Score |

| Conventional Loan | 620 |

| FHA Loan | 500 (can be 580 with 3.5% DP) |

| USDA Loan | 580 |

| VA Loan | N/A (but some lenders may need a 620 score) |

| Jumbo Loan | 700 |

What Credit Score Is Considered Good for Purchasing a Home?

To buy a home in the U.S., experts generally recommend having a credit score of at least 700. If your credit score is 740, you’re more likely to qualify for some of the best interest rates. And if your FICO score exceeds 760 or 780, your chances of securing even better rates increase further.

The rule of thumb is: the higher the score, the better. If your credit score is below 700, you may still qualify for a mortgage, but your interest rates will likely be higher.

However, it’s important to remember that credit score isn’t the only factor influencing interest rates. Lenders also consider other factors, such as DTI ratio, income, and employment history, when evaluating your application.

Learn more about a good credit score for a home loan here.

Ways to Increase Your Credit Score

-

Clear Your Outstanding Balances

Paying off credit card bills on time is one of the best solutions to improve your credit score—especially if you’re close to reaching your credit limit.

-

Maximize Your Credit Utilization Ratio

This ratio shows what percentage of your credit limit is in use at a given time. Lowering this ratio can help your score significantly. You can do this by paying down debt or requesting a credit limit increase. Experts suggest keeping your utilization below 30% of your total credit limit. Also, avoid closing old credit accounts, as a longer credit history can benefit your score.

-

Avoid Applying for New Credit Accounts

Steer clear of opening new lines of credit in the months before applying for a mortgage—hard pulls on your report can temporarily dent your score.

-

Make Payments on Time

Late payments can have a negative impact for a longer period, remaining on your credit report for up to seven years. Start paying all your bills on time to build a solid payment history.

-

Ensure Your Credit Report Is Accurate & Up-to-Date

Accuracy matters. Get your free credit report at AnnualCreditReport.com & review it for any errors or outdated information. Make sure you dispute inaccuracies promptly to ensure your score reflects your true credit standing.

Apart from ensuring a good credit score, you must take care of certain things while buying a house, especially if you’re a first-time home buyer.

Tips to Buy a Home When Your Credit Score Is Low

-

Look for an FHA Loan

Federal Housing Administration (FHA) loans are backed by the federal government and are designed to help buyers with lower credit scores. If you have a steady income & stable employment, an FHA loan might be a good option. A down payment of 10% can strengthen your application and reduce long-term costs. Otherwise, be prepared to pay mortgage insurance—unless you put down 10% or consistently make on-time payments for 11 years.

-

Shop Around

Don’t settle for the first lender you find. Different lenders have different eligibility criteria, and shopping around can help you find better terms. Be open about your financial situation and focus on convincing lenders that, despite your low credit score, you’re a responsible and reliable borrower.

-

Consider Refinancing Later

You might need to accept a mortgage with a higher interest rate initially. But once your credit score improves, you can refinance your loan at a lower interest rate and potentially lower monthly payments. Keep in mind, though, that refinancing may reset the loan term.

-

Onboard a Co-borrower

If you're struggling to qualify for a loan on your own, having a co-signer with strong credit can help. A co-signer acts as a safety cover for the lender who agrees to take responsibility if you default. Just make sure to keep up with your payments—any missed payments will impact both your credit and your co-signer’s.

Final Thoughts

Your credit score is a powerful tool when it comes to buying a house—it can open doors to better mortgage options, lower interest rates, and more manageable monthly payments. While a score of 620 is generally the minimum requirement for conventional loans, aiming for a higher score can extensively improve your chances of approval and save you money in the long run. By understanding how credit scores work, monitoring your report, and taking steps to improve your financial discipline, you can position yourself as a strong borrower and move one step closer to owning your dream home.

For any assistance regarding home loans and credit scores, you can get in touch with experts at Total Mortgage.

Get Pre-Qualified in 60 Seconds!

Find out what you can afford with no hard credit check, just a few simple questions.

Select the type of loan that best fits you