What is the Lowest Credit Score to Purchase a House?

Published: August 11, 2025 | 8 min read

Are you worried that a low credit score is standing between you and your dream home? You're not alone. However, the good news is, it doesn’t have to stay that way. While a low credit score can impact your financial options, it’s not a permanent roadblock. With the right steps, you can improve your score and move closer to qualifying for a mortgage—with better terms and rates.

Keep reading as we break down what counts as a low credit score, how it impacts your mortgage eligibility, and most importantly—how to start turning things around.

What Is Considered a Low Credit Score?

The term “low credit score” refers to a score that falls below the average range used by most lenders. It doesn’t mean you’re financially irresponsible — it just indicates that your credit history may include things like missed payments, high credit usage, or limited credit experience.

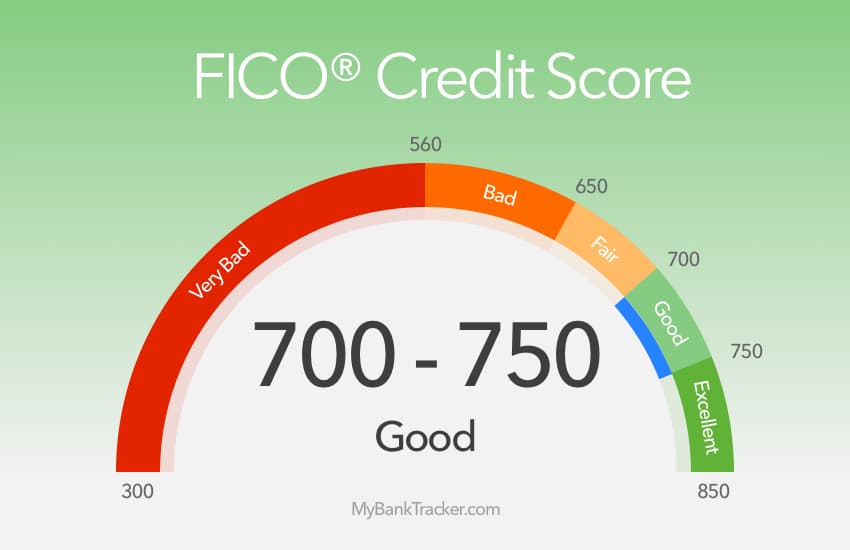

Here’s how credit scores are typically categorized using the FICO model:

| Credit Score | Rating |

| 300-579 | Poor |

| 580-669 | Fair |

| 670-739 | Good |

| 740-799 | Very Good |

| >800 | Excellent |

The potential lowest credit score is 300, but that doesn’t mean it’s where everyone starts. In fact, you won’t have a credit score at all until you’ve opened a credit account and your payment activity is reported to the major credit bureaus. If you’re paying your bills on time and using credit responsibly, your starting score could fall in the fair range, typically in the 600s. A score closer to 300 usually indicates significant negative marks on your credit report, such as missed payments, defaults, or collections.

What are the Lowest Credit Scores for Different Mortgages?

| Mortgage Types | Lowest FICO Scores |

| FHA | 500 (580 with a 3.5% down payment) |

| VA | Not Minimum (some may require a score of 620) |

| Conventional Loans | 620 |

| USDA | 580 |

| Jumbo Loan | 700 |

Why Do People Have Low Credit Scores?

Contrary to popular belief, your credit score doesn’t start at zero. In fact, it begins to build once you’ve opened an account that’s reported to the credit bureaus. A score as low as 300 usually reflects negative activity, not just a lack of credit history. Your credit score depends on several factors, including how reliably you pay bills, how much debt you carry, how long you’ve used credit, how often you apply for new accounts, and the variety of credit types you use.

When someone ends up with a low score, it’s often because one or more of these areas have taken a hit. Since lenders use your credit score to measure how risky it is to lend you money, certain behaviors can signal financial trouble.

Here are five common reasons your credit score might be low:

-

Late or missed payments

Your payment history carries the most weight in your credit score. Even just one late payment can cause a noticeable dip, especially if it goes unpaid for too long.

-

Accounts in collections

If a debt goes unpaid for a longer duration, lenders may hand it over to a collection agency. This shows up as a serious negative entry on your credit report and can stick around for years.

-

Bankruptcy or foreclosure

Major credit events like bankruptcy or foreclosure have long-lasting impacts. Depending on the type, they can remain on your credit report for seven to ten years and can significantly drag your score down.

-

Frequent credit applications

Every time you apply for a loan or a new credit card, a hard inquiry is made on your report. Too many of these in a short time can suggest financial instability and hurt your score.

-

Credit report errors

Mistakes happen, and they can lower your score. Whether it’s a payment wrongly marked as missed or an account you don’t recognize, it’s important to check your report regularly and dispute any inaccuracies.

While not all of these factors carry the same weight, they all play a part in how lenders view your financial reliability. The good news? Even if your score is low now, most credit damage isn’t permanent — with the right steps, you can start rebuilding over time.

How a Low Credit Score Can Impact You

Having a low credit score doesn’t just impact your ability to get a mortgage or loan; it can affect multiple things in your life, sometimes in unexpected ways. Here are some of the most common challenges people face when their score is less than ideal:

-

Lower credit limits

-

Higher interest rates on loans & credit cards

-

Increased insurance premiums

-

Difficulty getting approved for rental housing

-

Rejections for loans or new lines of credit

Lenders, landlords, banks, and even some employers use your credit score to see how financially proactive and responsible you are. If your score falls in the “Poor” or “Fair” range, it can raise red flags. It might signal that you’re more likely to miss payments or struggle with debt, which can make them hesitant to work with you.

It can make it harder to get approved for loans or credit cards. And even if you are approved, you're likely to face higher interest rates, which means you’ll pay more in the long run. Banks are also less likely to increase your credit limit or offer you new credit if your score is on the lower end.

Even outside of lending, your credit score matters. Landlords often check credit as part of the rental application process, and many won’t accept tenants with scores below a certain level. Some employers, especially for roles involving finances or sensitive information, may also check your credit history as part of their hiring decision.

In short, a low credit score can limit your financial options, but understanding its impact is the first step toward improving it.

6 Smart Ways to Rebuild and Improve a Low Credit Score

Raising your credit score takes time, but it’s absolutely doable—even if you’re starting at the bottom. Whether you’re aiming for a solid score or working toward that elusive perfect 850, adopting the right habits can lead to steady progress. Here are six effective strategies to help you turn things around:

-

Clear Up Collection Accounts

Outstanding collection accounts can drag your score down fast. If possible, pay these off to start repairing your credit. You can also try sending a pay-for-delete request, which asks the collection agency to remove the account from your credit report once it’s paid.

-

Correct Any Inaccuracies

Credit reports aren’t always perfect. If you spot an error—like a payment marked late when it wasn’t—file a dispute with the credit bureau. Fixing even one mistake could give your score a noticeable bump.

-

Set Up Auto-Pay for Bills

Your loan repayment history is the largest part of your credit score, so making payments on time is super important. Therefore, set up automatic payments to avoid any late fees or missed due dates. Paying at least the minimum is better than missing a payment—but paying more when you can is even better.

-

Ensure Low Credit Balance

Your credit utilization ratio is the percentage of your available credit limit that you’re currently using. Try to keep it under 30% to show lenders you’re managing your debt responsibly. For example, if your credit limit is $1,000, you must try to keep your balance under $300.

-

Keep an Eye on Your Credit

When you check your credit score on a regular basis, you are able to track your progress and detect any issues early. You’ll be able to see what’s helping or hurting your score and stay motivated as you make improvements.

-

Use Credit Wisely and Strategically

While applying for too many credit cards at once can be a red flag, opening a new line of credit occasionally can be a smart move. It increases your overall credit limit (which lowers utilization) and, over time, improves your credit mix and credit age—two key factors in your score.

Summing It Up

A low credit score doesn’t have to stay that way forever. With consistent effort and smart financial habits, you can raise your score and qualify for loans with more favorable terms. Practice financial discipline—monitor your credit report for errors, pay your bills on time, and consider a co-signer if needed.

It’s also important to maintain a credit score of at least 580 to improve your chances of securing better mortgage options.

Need more information or personalized guidance? Give us a call at Total Mortgage.

FAQs

-

Can a credit score really go as low as 250?

Yes, although it depends on the type of score. The regular FICO score ranges from 300 to 850, but FICO also provides specialized scores—like those used for auto loans or credit cards—that can range from 250 to 900.

-

Is it possible to get a loan with a 300 credit score?

While it’s not easy, getting a loan with a 300 credit score isn’t impossible. However, you’ll probably face higher interest rates and stricter terms. Lenders that work with low-credit borrowers—often called subprime lenders—might be your main option.

-

Can a credit score of 300 be improved?

Absolutely. Even if your score has hit rock bottom, it’s possible to rebuild. Making payments on time, keeping credit balances low, and correcting any inaccuracies on your credit report are key steps toward recovery.

-

What’s the maximum credit score someone can achieve?

The highest FICO score attainable is 850, which is considered exceptional. It’s a rare achievement—only about 1.54% of Americans had an 850 score as of 2024, according to Experian®.

Get Pre-Qualified in 60 Seconds!

Find out what you can afford with no hard credit check, just a few simple questions.

Select the type of loan that best fits you