What's A Good Credit Score To Buy A House?

Published: June 4, 2024 | 6 min read

Lenders offering mortgage loans have one crucial criterion: a good credit score. This parameter showcases your ability to make timely payments. If your credit score is below average, you might still qualify for a mortgage, subject to certain conditions. However, if your credit score exceeds the average, it’s an added advantage because you are eligible for better loan alternatives with lower interest rates. Different lenders have different requirements for credit scores for mortgage loans.

Continue reading to learn more about the ideal credit score for mortgages.

Want to Buy a House? What is the Ideal Credit Score for a Mortgage?

If you are wondering, “What is a good credit score for buying a house in the U.S.?” then you must know that most lenders require a minimum of 620 credit score for a mortgage.

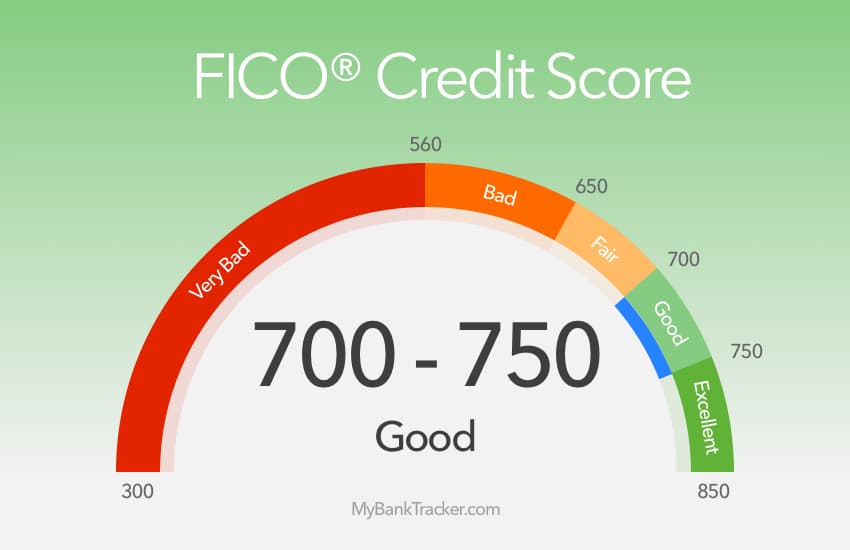

Higher scores can help improve the likelihood of getting approvals for higher amounts and lower interest rates. The FICO score is the most used system to determine your creditworthiness by mortgage lenders. If you have a credit score of 740 or more, chances of getting a low interest rate are possible.

If you have a low credit score, it is recommended that you improve the score before applying for a loan. You can speak with a qualified housing counselor for guidance.

Details of Minimum Credit Scores by Loan Type

Conventional loan: High Credit Score Requirement

This loan requires applicants to have a minimum credit score of 620. However, conventional loans usually demand a higher home loan credit score. This means with a higher credit score, the interest rate is lower.

Other advantages include -

-

Relief in the Private Mortgage Insurance (PMI) costs if the down payment is less than 20%.

-

If your credit score is 620 and you are making a 10% down payment, your PMI will be 1.1%, while a person with a 760 score will pay only 0.3% as PMI.

FHA loan: Low Credit Score Requirement

A conventional mortgage might not work for you if you have a low home loan credit score. You can apply for an FHA loan, insured by the Federal Housing Administration (FHA). For an FHA loan, the minimum credit score is 500. However, each lender can have its own credit score requirements. If your score is lower than the required, your loan approval may take considerable time and may not come quickly.

Things to note -

-

If your FICO score is 580 or higher, you can get an FHA loan with a down payment of 3.5%.

-

Between 500 - 579, the down payment will be 10%.

-

Even though your loan is insured by FHA, and you have a credit score of 500, the lender might have clauses related to judgments, collections, and liens.

VA loan: Low to Medium Credit Score Requirements

The Department of Veterans Affairs (VA) guarantees VA loans. The government usually doesn’t have a set credit score for a house loan, but VA lenders decide their own credit scores. The usual range lies in the 600s.

The only requirement is that the applicant must be actively in the military, a veteran, or their eligible spouses. The final decision on the minimum credit scores is with VA lenders and differs from lender to lender.

USDA loan: Medium Credit Score Requirements

The US Department of Agriculture offers this loan, and the minimum credit score is not set. The usual score required for a USDA loan is 640. Lenders can have their criteria for minimum credit scores. If your score is over 640, you can avail of streamlined credit processing for a loan.

Jumbo loan: High Credit Score Requirement

Lenders typically demand a minimum credit score of 700 to get a jumbo loan. Some lenders could even demand a score as high as 760. Since Jumbo home loan credit scores are pretty high, lenders assess the applicant's financial health to take the risk. If your credit score is more than 740, you can get a reasonable mortgage rate.

What Other Factors Are Considered By Lenders For Approving a Mortgage?

A credit score is one of the top considerations for lenders when approving a mortgage. But there are other considerations, too, including:

-

Loan-to-Value (LTV) Ratio

The LTV ratio shows the money you owe on loans. Lower LTV means it is less risky for lenders to give you a loan. Try to make a higher down payment to improve your LTV.

-

Debt-to-Income (DTI) Ratio

Expressed as a percentage, DTI tells lenders about your current debts and whether you can take the burden of another debt. DTI showcases your monthly loan payments vis-a-vis your monthly earnings. A lower DTI is a good sign. Lenders usually look for DTI lower than 36%.

-

Your Income & Employment Record

Lenders naturally check employment history to verify that you have had a regular source of income for at least the previous two years. Your income and employment tell the lender whether you have the capacity to repay the loan or whether it will be challenging for you. If you are not working or retired, you must submit other documents as proof of your capability to make your monthly payments toward the mortgage.

-

Savings and Assets

Lenders will consider your overall net worth. They will closely assess your investments, cash savings, savings towards retirement, and other assets, which will give them a better impression of your financial health.

If My Credit Score is Not High Enough, Can I Buy a House?

If your credit score is relatively low, for example, in the case of bad credit or no credit, you may not get approval for a mortgage. You might need the help of someone as a co-signer to help secure the loan.

Checking Your Credit Rating for Mortgages & Keeping a Check

You can learn about your credit rating for mortgages without paying, like applying for a credit card or personal finance. Many finance websites offer access to credit scores. These sites use the VantageScore model, not the FICO system but a competitor. Lenders, however, will use the FICO 2, 4, or 5 versions to check your credit score. These days, lenders use advanced technology like FICO 10T and VantageScore 4.0, which use a range of data sources to get a more comprehensive view of the credit status of borrowers.

If you want to access the actual FICO score that your mortgage lenders will review before approving a loan, you must buy a FICO report from myFICO.com by paying an upfront fee.

If your credit score is pretty high, like 720 or more, you do not have to check your FICO scores before applying for a mortgage. You can be sure of getting approval since your credit score is high.

If you have understood the ideal credit score for mortgages and want to apply for a home loan, checkout Total Mortgage.

Get Pre-Qualified in 60 Seconds!

Find out what you can afford with no hard credit check, just a few simple questions.

Select the type of loan that best fits you