How to Improve Your Credit Score to Secure A Better Mortgage Rate

Published: January 11, 2024 | 4 min read

If you're looking to buy a home, improving your credit score should be one of your top priorities. Your credit score plays a crucial role in determining the mortgage rate you'll be offered by lenders. A higher credit score can lead to better loan terms, potentially saving you thousands of dollars over the life of your loan. So, how can you improve your credit score to secure your dream home with a favorable mortgage rate? Read below to find out!

Key Takeaways:

-

Having a good credit score is important for a lender when determining the interest rate for your loan

-

Lenders use your credit score to assess your creditworthiness and your ability to pay back your the debt you owe

-

Higher credit scores can result in lower mortgage rates

-

Improving your payment history and lowering your debt utilization can positively impact your credit score

-

Avoid applying for new credit cards or loans unless necessary to prevent temporary drops in your credit score

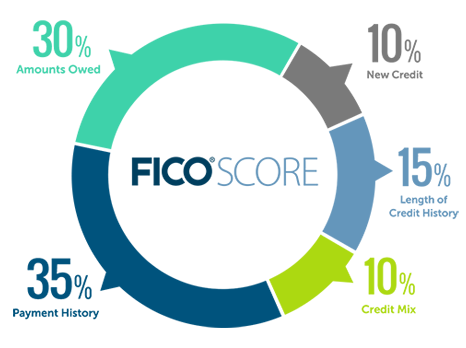

What Makes Up Your Credit Score?

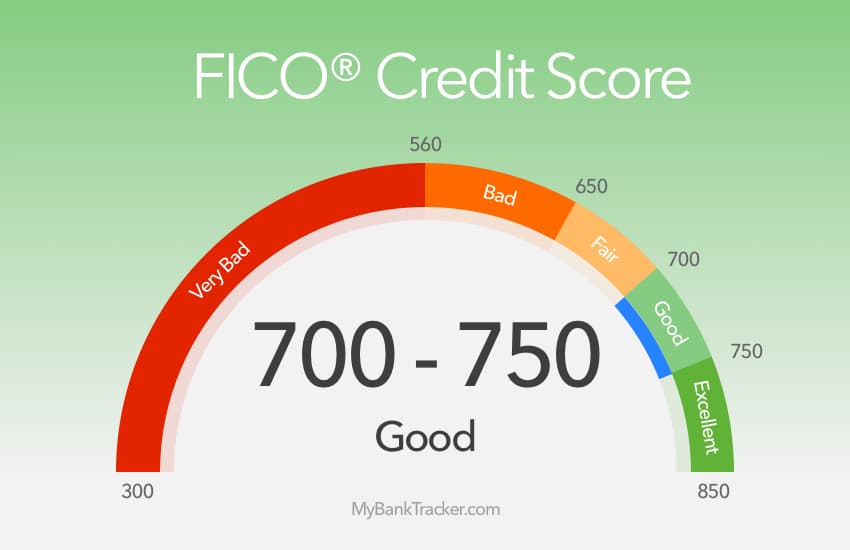

Click here to learn more about how FICO scores are calculated.

Understanding the Impact of Credit Score on Mortgage Rates

While mortgage rates vary from one lender to another, your credit score plays a significant role in determining the interest rate you'll be offered on a mortgage. Lenders use the FICO score, which ranges from 300 to 850, to assess your creditworthiness and determine how much of a risk factor you are to pay back your debt. The higher your credit score, the lower risk associated with you as a borrower. Having lower risk will help you secure lower mortgage rates and better loan terms.

However, it's important to note that even if your credit score is less than perfect, there are steps you can take to improve it and increase your chances of getting a favorable mortgage rate.

Tips for Improving Your Credit Score

Improving your credit score requires patience and discipline. By taking proactive steps, you can enhance your creditworthiness and increase your chances of securing better loan terms. Here are some tips to help you improve your credit score:

-

Check your credit report: Start by reviewing your credit report for any errors or inaccuracies. If you find any discrepancies, dispute them immediately to ensure your credit history is accurately reflected. Be sure to check your credit score from all three credit bureaus: Transunion, Equifax, and Experian. These scores may be slightly different, but can give you important insight as to what is helping or hurting your current score.

-

Make on-time payments: Payment history makes up 35% of your FICO Score calculation! Aim to make all of your bill payments on time, as late or missed payments can negatively impact your creditworthiness. A helpful tip to stay on time with your payments is to set up automatic payments for your credit cards or set reminders on your cell phone to help you stay on track.

-

Reduce your debt: Focus on paying down your debts, especially credit card balances. By lowering your debt utilization ratio (the balance of debt to your total available credit line) to below 30%, you can boost your creditworthiness.

For example, if you have a $10,000 limit on your credit card, try to keep your monthly balance at $3,000 or below. A great way to improve your debt utilization ratio is to increase your credit limit. This would lower the percentage of your balance without having to spend less on your credit card.

-

Avoid new credit applications: Applying for new credit cards or loans can temporarily lower your credit score. However, each application generates a hard inquiry on your credit report, which can impact your score.

*Important note: Only inquiries within the last 12 months are assessed and reflected in your score. Therefore, if you are looking to buy a home in the near future, it is best to avoid opening new lines of credit or applying for any other loans within 12 months of submitting your home loan application.

We are not trying to discourage you from applying for another credit card! Credit mix is another important factor in determining your score.

Wrapping It Up

Improving your credit score is critical when it comes to securing a mortgage. By taking steps to increase your credit score, you can unlock better loan terms and lower interest rates, which can help you secure your dream home on your terms!

By following the tips outlined in this guide, such as checking your credit report for errors, making on-time payments, reducing your debt utilization, and being cautious with new credit applications, you can proactively improve your credit score and increase your chances of obtaining a competitive mortgage rate in today’s market.

Remember, starting early is key. Whether you're planning to buy a home in the near future or further down the line, it is never too late to take action. Don't wait to improve your financial future and position yourself for success!

Source Links: https://www.myfico.com/credit-education/improve-your-credit-score

https://www.wsj.com/buyside/personal-finance/mortgage-rates-by-credit-score-287bb3d8

Total Mortgage Services, LLC is not a credit repair organization as defined under federal or state law, including the Credit Repair Organizations Act. Total Mortgage Services, LLC does not provide "credit repair" services or advice or assistance regarding "rebuilding" or "improving" your credit record, credit history or credit rating. FTC's website on credit https://consumer.ftc.gov/credit-loans-and-debt/credit-and-debt

Get Pre-Qualified in 60 Seconds!

Find out what you can afford with no hard credit check, just a few simple questions.

Select the type of loan that best fits you