Apply Now

Ready to start your home buying journey? Apply now and get pre-approved for your mortgage.

Purchase Rates

Know the rates, know your options. Start building your homeownership plan today.

Monthly Mortgage Calculator

Get a clear picture of your monthly mortgage payment using your rate, credit score, and down payment information.

Affordability Calculator

Not sure what fits your budget? This calculator factors in your income, debts, and down payment to help you find the right price range.

Apply Now

Ready to lower your rate or tap into your equity? Apply now and start your refinance journey with confidence.

Refinance Rates

Rates can change fast. See today's options and discover potential savings on your mortgage.

Refinance Mortgage Calculator

Wondering how refinancing will affect your monthly payments? See how much you can save.

Cash-Out Refinance Calculator

See how much equity you can tap into. Estimate your new mortgage payment and compare loan options.

Calculators

Free, interactive mortgage calculators that can help you along the journey toward your home ownership goals.

Blog

Learn more. Stress less. Our blog breaks down what you need to know to buy, refinance, or plan ahead.

FAQs

Check out our FAQs to learn more about Total Mortgage, mortgage lending, home refinancing, and more.

Loan Products

Navigate all our loan product options and find the perfect loan for you.

Buy

Apply Now

Ready to start your home buying journey? Apply now and get pre-approved for your mortgage.

Purchase Rates

Know the rates, know your options. Start building your homeownership plan today.

Monthly Mortgage Calculator

Get a clear picture of your monthly mortgage payment using your rate, credit score, and down payment information.

Affordability Calculator

Not sure what fits your budget? This calculator factors in your income, debts, and down payment to help you find the right price range.

Refinance

Apply Now

Ready to lower your rate or tap into your equity? Apply now and start your refinance journey with confidence.

Refinance Rates

Rates can change fast. See today's options and discover potential savings on your mortgage.

Refinance Mortgage Calculator

Wondering how refinancing will affect your monthly payments? See how much you can save.

Cash-Out Refinance Calculator

See how much equity you can tap into. Estimate your new mortgage payment and compare loan options.

Rates

Resources

Calculators

Free, interactive mortgage calculators that can help you along the journey toward your home ownership goals.

Blog

Learn more. Stress less. Our blog breaks down what you need to know to buy, refinance, or plan ahead.

FAQs

Check out our FAQs to learn more about Total Mortgage, mortgage lending, home refinancing, and more.

Loan Products

Navigate all our loan product options and find the perfect loan for you.

Customers

About

Mortgage Basics

What Is a Home Title? Complete Guide for Homebuyers

Learn what a home title is, how it differs from a deed, who holds title with a mortgage, and how title insurance protects homebuyers.

Clear to Close (CTC): What it Means and Next Steps

Clear to Close means your mortgage is fully approved and you’re ready for closing. Learn what CTC means, how long it takes, and what happens before closing day

How much do first-time home buyers have to put down in Massachusetts? (MassHousing)

How much do first-time home buyers need to put down in Massachusetts? Here are MassHousing programs, DP assistance options, and low-down-payment mortgage needs.

How Long Does a Mortgage Preapproval Last?

Getting a preapproval on a mortgage is important when you're buying a home. This post is all about how long is a preapproval valid, and when does it expire?

When Applying For A Mortgage What Is Considered Debt?

Understanding what lenders consider as debt is key to qualifying for a mortgage. This guide breaks down the types of debt that affect your mortgage application.

Do You Need to Put 20% Down to Buy a House?

Do you need 20% down to buy a house? Learn the truth about down payments, low-down-payment loan options, and how to buy with less.

How Soon After Closing Can You Move In?

Find out how soon you can move in after closing. Learn about occupancy dates, seller agreements, and what to expect with new or pre-owned homes.

How Do I Get Prequalified for a Home Loan?

Are you dreaming of buying a home but not sure where to start? A great first step is getting prequalified for a home loan. Here is how to get prequalified.

How to Choose a Mortgage That Actually Works for You?

Find the right mortgage for your budget and goals. Learn about loan types, rates, and tips from Total Mortgage to choose a plan that truly works for you.

Employment Letter for Mortgage Approval

Learn what an employment letter for mortgage approval is, why lenders need it, and how to get one—expert guidance from Total Mortgage.

Thinking About Using Retirement Savings to Pay Off Your Mortgage? Here’s What to Consider

Thinking of using retirement savings to pay off your mortgage? Learn the pros, cons, tax impacts, and risks to decide if it’s the right move for you.

"Lease to Keys" Program Helps First-Time Home Buyers with Closing Costs

The Lease to Keys program gives renters in the U.S. up to $2,500 in closing costs to help you buy your first home.

For a 100k Salary, How Much Home Can You Afford?

Find out how much home you can afford on a $100k salary, factors that impact your budget, and tips for smarter mortgage planning.

Exploring Low-Income House Buying Options

Explore low-income house buying options, including government programs, grants, and tips to qualify for affordable homeownership.

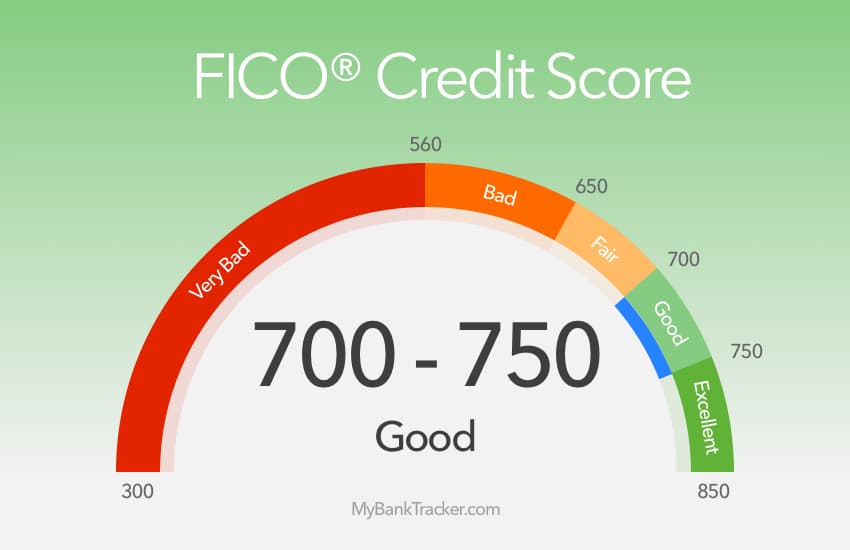

All You Need to Know About the Credit Score Needed to Buy a House

Learn the credit score needed to buy a house, how it impacts mortgage rates, and ways to improve it for better home loan approval.

What is the Lowest Credit Score to Purchase a House?

Discover the lowest credit score needed to buy a house, lender requirements, and tips to boost your score for better mortgage approval chances.

What Credit Scores Do Mortgage Lenders Use?

Find out which credit scores mortgage lenders check, how they affect your loan approval, and tips to improve your score for better rates.

Why Are Mortgage Rates So High in 2025?

Mortgage rates in 2025 remain high, dampening buyer hopes. Explore why rates are so elevated, the inflation impact, and whether relief is expected anytime soon.