How much do first-time home buyers have to put down in Massachusetts? (MassHousing)

Published: November 13, 2025 | 5 min read

Buying your first home in Massachusetts with MassHousing? Congratulations on this exciting decision! The good news is that this mortgage program does not require a large down payment up front. MassHousing offers several programs that combine affordable mortgage loans with Down Payment Assistance (DPA) to help first-time buyers cover the gap.

With MassHousing’s ONE Mortgage Program, first-time homebuyers can make a down payment as low as 3% to 5%, depending on the type of home. Over 90,000 people have used MassHousing programs to purchase their first home in Massachusetts.

Introducing MassHousing

MassHousing is a Massachusetts-based not-for-profit mortgage lender created by the state government. However, it does not receive direct government funding.

The organization offers mortgage programs for first-time homebuyers in Massachusetts, focusing on helping buyers rather than generating profits. It works in partnership with various mortgage lenders, banks, and credit unions.

In addition, MassHousing provides down payment assistance, helping buyers who may face challenges in covering the down payment achieve their dream of homeownership.

All loan application paperwork is completed through a chosen lender partner.

Details of the ONE Mortgage Program

The ONE Mortgage Program is Massachusetts’ most popular mortgage program. It’s highly affordable, making it ideal for low- and moderate-income families buying their first home. Currently, 40 lenders participate in the program.

Key Features of the ONE Mortgage Program

- 30-year fixed-rate mortgage

- Down payment as low as 3% (depending on home type)

- Low interest rates

- Zero private mortgage insurance (PMI)

- Additional subsidies for qualified borrowers to reduce monthly payments

The program was launched in 1990 as SoftSecond. Since then, more than 22,000 low- and moderate-income households have purchased their first home in Massachusetts through the ONE program.

How Much Do You Actually Need to Put Down?

Minimum Down Payment

- Single-family homes, condos, and two-family homes: 3% of the purchase price

- Three-family homes: 5% of the purchase price

This is much lower than the traditional 20% down payment most people think they need.

Down Payment Assistance (DPA)

Saving for a down payment is often the biggest hurdle for first-time buyers. MassHousing offers Down Payment Assistance programs that can provide up to $30,000 toward your down payment. This assistance is available in every city and town in Massachusetts and can be combined with other local or national programs.

What this means for buyers:

- You can put down as little as 3%–5% of the home price and still have help covering the rest

- Less upfront cash needed, making homeownership achievable sooner

Eligibility for DPA:

- Minimum credit score of 640

- Completion of a homebuyer education course

- Household income within MassHousing limits

- Work with a MassHousing-approved lender

Who Can Apply for MassHousing’s ONE Mortgage Program?

The following criteria apply:

- First-time homebuyer: This must be your first home ever, or you must not have owned a home in the last three years.

- Down payment: 3% of the purchase price for a single-family home, condo, or two-family home; 5% for a three-family home.

- Down payment sources: Assistance programs or gifts from family can be used.

- Homebuyer education: Participation in a homebuyer class is required to prepare you for the process.

- Credit score: Minimum 640 for a single-family home or condo; 660 for a two-family or three-family home. Individuals without a credit history may also apply.

- Household income: Must fall within limits based on household size and community.

- Primary residence requirement: The home must be your primary residence. If you move, the ONE mortgage must be refinanced.

- Household assets: Total assets, including savings, checking accounts, bonds, and stocks, must be under $75,000 (excluding college savings and retirement accounts).

Additionally, Section 8 voucher holders can become homeowners using the Section 8 Homeownership Program. These borrowers can use their Housing Assistance Payments (HAP) to make mortgage payments for a condo or single-family home.

What Makes Buying a Home with ONE Mortgage Program Affordable?

There are four main reasons why the ONE Mortgage Program from MassHousing is so popular in Massachusetts:

- Low down payment: Only 3% to 5% of the home’s purchase price.

- Fixed interest rates: Lower than many other mortgage types.

- No Private Mortgage Insurance (PMI): Homebuyers are not burdened with this extra cost.

- Additional assistance: Qualified buyers can receive extra help to reduce monthly payments.

Steps to Apply for the MassHousing ONE Mortgage Program

- Sign up for a homebuyer class designed for first-time homebuyers.

- Apply for a mortgage by contacting partner lenders, including banks and credit unions.

- Check eligibility for the down payment assistance program.

- Find a home and finalize the offer with the seller, then complete all the required formalities for the ONE mortgage loan.

Why Are MassHousing Loans Preferred by First-Time Buyers?

First-time homebuyers in Massachusetts often choose MassHousing programs for three main reasons:

- Down Payment Assistance: One of the biggest hurdles for homebuyers is saving for a down payment. MassHousing’s assistance programs make this easier and are available across all cities and towns in Massachusetts. These programs can also be combined with other community loans.

- MI Plus Benefits: MassHousing offers mortgage insurance called MI Plus, which helps cover your mortgage payments if you lose your job. It covers principal and interest payments up to $4,000 per month and is provided at no extra cost for all MassHousing loans.

- Low and Fixed Interest Rates: MassHousing loans come with low, fixed interest rates and no hidden fees. Borrowers can contact the local customer care team for support at any time.

Work with Total Mortgage for MassHousing Loans

With MassHousing, first-time homebuyers in Massachusetts can buy a home with as little as 3%–5% down, and potentially use up to $30,000 in Down Payment Assistance. Combined, these programs make owning your first home much more attainable than the old 20% down payment rule suggests.

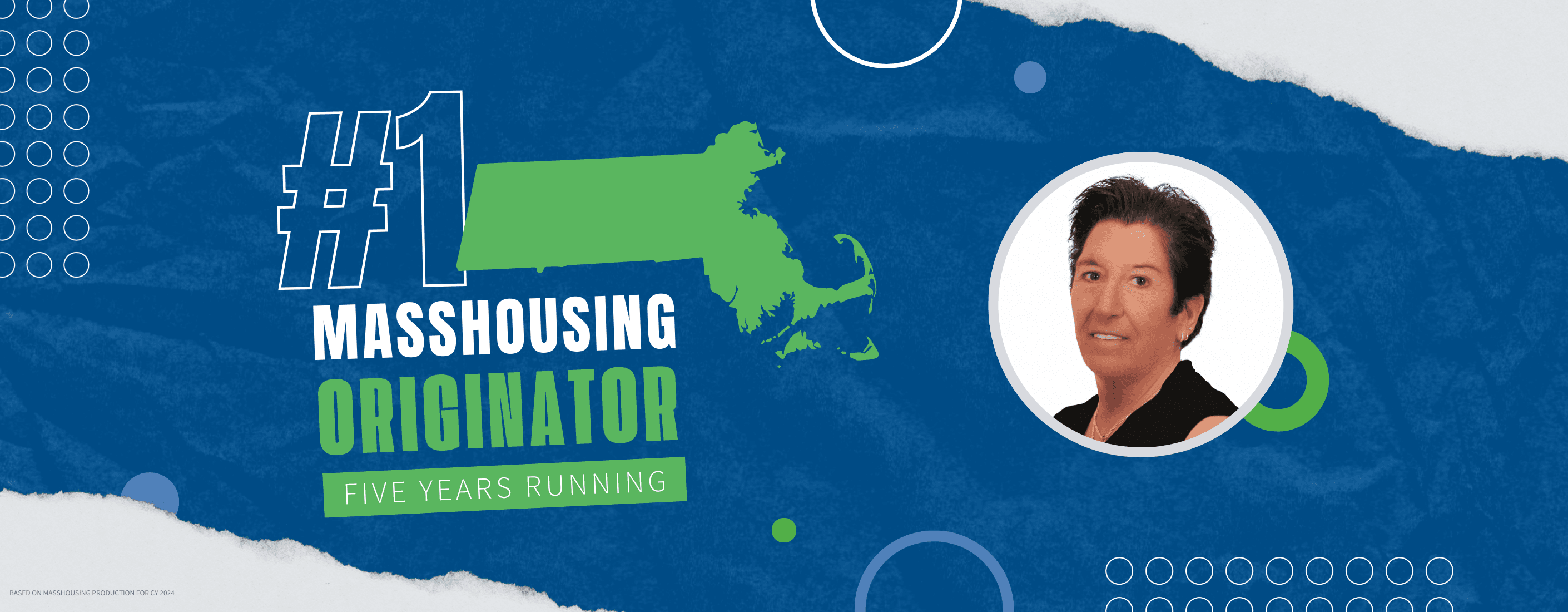

Working with a knowledgeable MassHousing-approved lender, like Denise Peach at Total Mortgage, ensures you get step-by-step support and maximize your benefits.

Want to learn more about MassHousing programs and down payment assistance? Reach out to us at Total Mortgage — we’ll guide you through the entire process.

Get Pre-Qualified in 60 Seconds!

Find out what you can afford with no hard credit check, just a few simple questions.

Select the type of loan that best fits you