Homeownership Rate Resumes Freefall

Published: August 10, 2016 | 5 min read

Where are the first-time homebuyers?

So where are the loses coming from? The Census Bureau reported homeownership rate for Americans ages 18-34 fell to 34.1 percent in the second quarter from 34.8 percent a year earlier, the Census Bureau said. The decline is within the margin of error for that age group of 0.8 percentage points, but that doesn’t mean it isn’t worrisome. A new study by the National Association of Realtors and SALT, a program provided by the American Student Assistance, found that nearly three-quarters of non-home owners say that repaying their student loan debt is delaying their home purchase. And that's not all. More than fifty percent of consumers say they expect to be delayed from buying a home by more than five years. Forty percent of consumers surveyed also said that student debt was delaying them from moving out of a family member’s house after graduating from college. The student loan debt burden seems to be holding back older millennials, aged 26 to 35, and those with $70,000 to $100,000 in debt the most from home ownership, the survey found.Minorities have been affected too

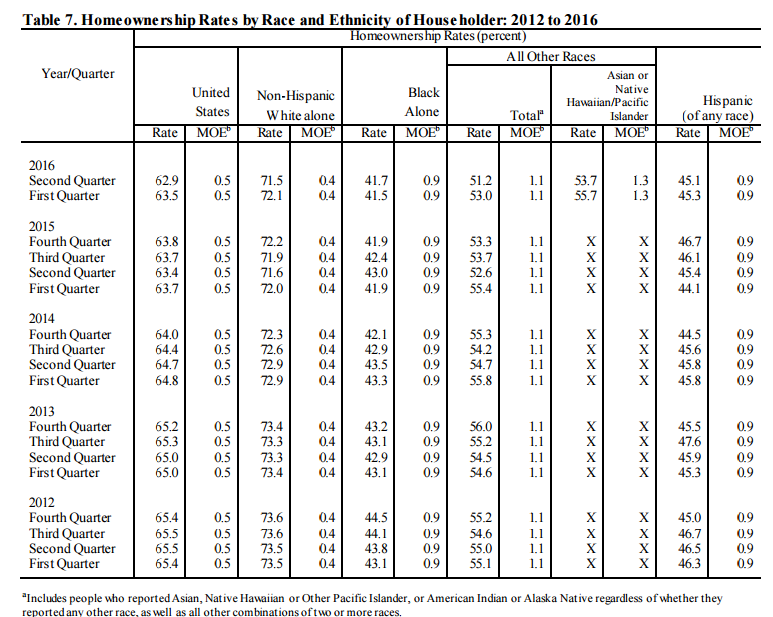

Homeownership among minorities is also declining once again. Among African Americans, the homeownership rate has fallen to 41.7 percent from 43 percent a year ago and among Hispanics, the rate is down slightly from the second quarter of 2015, to 45.1 percent from 45.4 percent. Among non-Hispanic whites, homeownership is statistically equal to a year ago, 71.5 percent in the second quarter of 2016 compared to 71.6 in the second quarter of 2015.

What does this mean for you?

All this seems to indicate that current middle-class homeowners are staying in their starter homes longer, while large groups of potential first-time homebuyers are staying out of the real estate game entirely, leaving a section of the real estate landscape stagnant in spite of improvements. If you're thinking about selling or buying, the timing is still good, but depending on your local market, either may take longer than expected.Get Pre-Qualified in 60 Seconds!

Find out what you can afford with no hard credit check, just a few simple questions.

Select the type of loan that best fits you