Understanding the updates to Reconsideration of Value (ROV) requests

Published: October 30, 2024 | 3 min read

Recently, the Department of Housing and Urban Development (HUD) and GSEs, such as Freddie Mac and Fannie Mae, announced a standardized procedure for managing borrower-initiated Reconsiderations of Value (ROVs) during the appraisal process.

These changes will come into effect on October 31, 2024. This means that loan applications dated October 31, 2024, or later, will undergo this procedure. In the case of FHA loans, case numbers assigned on or after this date will be subject to the same procedure.

The GSEs and federal banking regulators have emphasized the significance of financial institutions managing their relationships with service providers, including appraisers, to ensure compliance with consumer protection laws. These laws are made to safeguard the interests of consumers, preventing potential harm.

Appraisers have a critical role to perform in this spectrum. Their valuations need to be accurate, and they must ensure that they respond promptly to ROVs. In this way, appraisers can support compliance in the appraisal process and instill customer trust in the procedure.

At Total Mortgage, we stay up-to-date on industry regulations so our clients receive the most accurate & compliant guidance throughout the lending process. Thus, we will cover all the details of the Reconsideration of Value (ROV) updates.

Borrower-initiated Reconsideration of Value

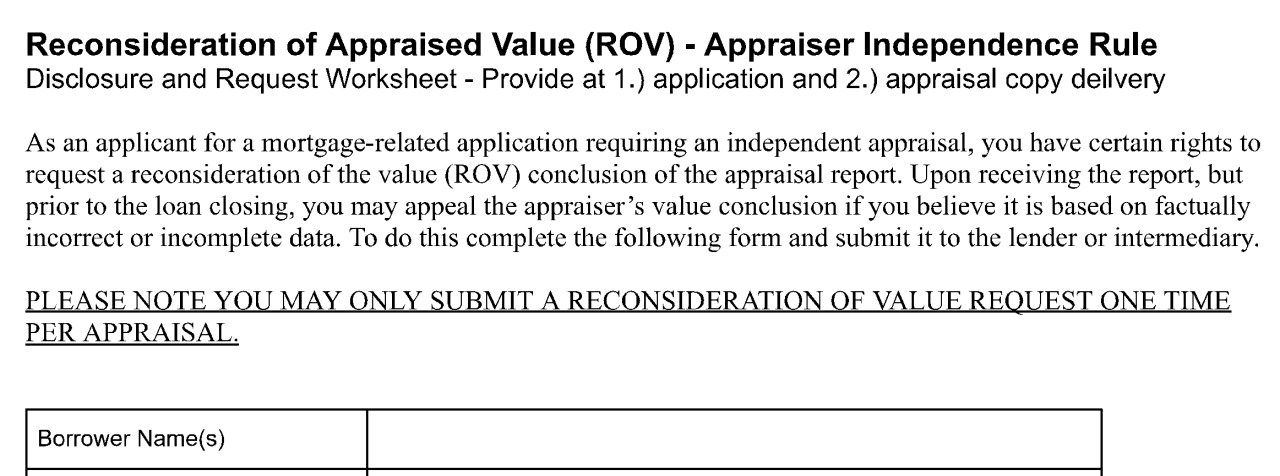

A ROV is a request letter to an appraiser to review and revise the appraisal. The borrower offers more details and information and asks for an updated valuation. This request often arises from concerns that the original appraisal may be biased, unsupported, or lacking in detail.

Appraisers should be familiar with essential aspects, including:

-

Resolution Timeline: It’s essential that the ROV is initiated and resolved before the loan closing, as borrowers cannot submit ROV requests once the loan is closed.

-

Disclosure to Borrowers: Lenders are required to inform the borrower about the ROV process. This disclosure must be provided both at the time of the loan application and when the appraisal report is delivered to the borrower.

-

Correcting Deficiencies: Should the appraisal report reveal significant deficiencies that affect its value or marketability or suggest a possible violation of anti-discrimination laws, these issues must be rectified in response to an ROV request. If these deficiencies are not resolved, the lender is obligated to report the appraisal and its findings to the relevant licensing or regulatory authority.

-

Misleading Valuation: According to GSE requirements, unacceptable appraisal practices encompass reporting a market value that lacks data support and is, therefore, misleading. Additionally, any suspected violations of anti-discrimination laws must be reported to the appropriate local, state, and federal agencies.

New ROV Guidelines

The new guidelines for ROV requests are as follows:

-

ROV requests must be handled with care. It's essential to thoroughly review any additional information provided and issue a revised appraisal report as needed.

-

Timeliness is critical. All ROV requests have a strict timeframe, so responding within 1 business day of receiving the request is vital to ensure issues are addressed fairly and efficiently.

-

Communication is key. If the appraiser is unable to meet these obligations, it’s important to notify the relevant parties without delay.

-

Reporting requirements have also been updated. Any unresolved material deficiencies must be reported to the appropriate regulatory or licensing authorities.

If you need guidance on starting a borrower ROV request or have any questions, don't hesitate to contact us.

Our knowledgeable team at Total Mortgage is ready to assist you!

Get Pre-Qualified in 60 Seconds!

Find out what you can afford with no hard credit check, just a few simple questions.

Select the type of loan that best fits you