you have questions, we have answers

Homeownership is a journey. Luckily, you can gear up with our collection of complete guides. To find the right one for you, browse or search below.

The Ultimate Green Home Buying Guide

The Ultimate Home Buying Guide

The Ultimate Guide to Refinancing Your Mortgage and Mortgage Refinancing Costs

The Guide to Understanding Your Credit

The Guide to Financial Planning for Servicemembers and Veterans

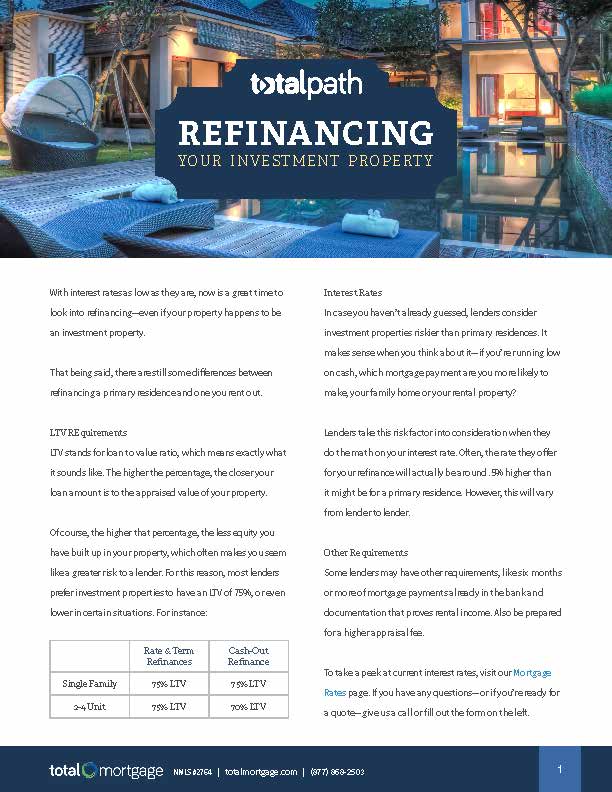

How to Refinance Your Investment Property

How To Buy A House Without A Realtor?

How to Keep Your Mortgage Refinancing Costs and Closing Costs Low

The Guide to Creating a Moving Plan

No Closing Cost Refinance: Everything You Should Know

Can a Non-US Citizen Get A Mortgage Loan?

Refinance Your Second Home or Investment Property

Home Refinance Appraisal Tips

Buying a Home After a Short Sale with an FHA Mortgage Loan

Mortgage Refinancing for Divorce Situations

Jumbo Mortgage Loan Down Payment Requirements

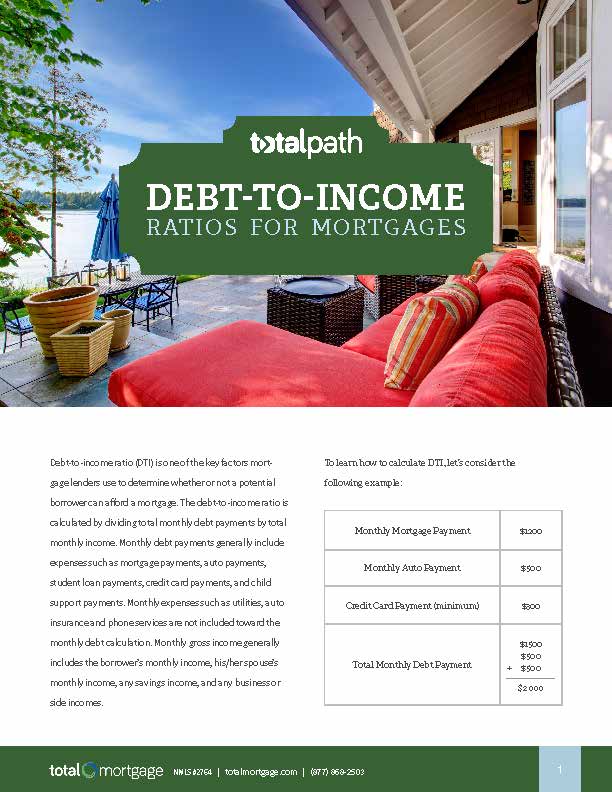

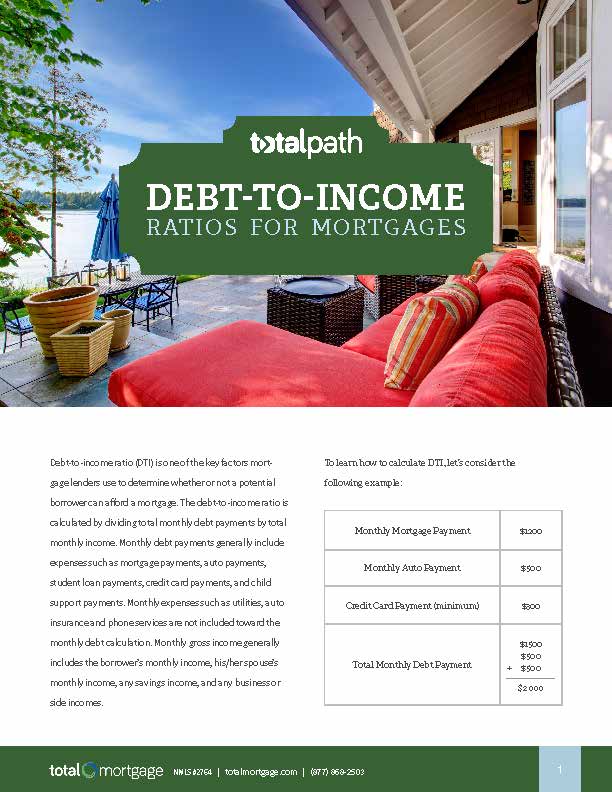

Debt-to-Income Ratios for Mortgages

FHA Home Loans with a Non-Purchasing Spouse: The Details Explained

Mortgage Refinancing Tips for Self-Employed Borrowers

Refinancing Owner-Occupied Multi-Family Properties

How Soon Can You Refinance a House After Purchasing?

Buying a Home While Disabled | Disability Home Loan Grants

Homebuying for Unmarried Couples

How to Choose Between an FHA and a Conventional Loan